Glory Tips About How To Increase Liquidity

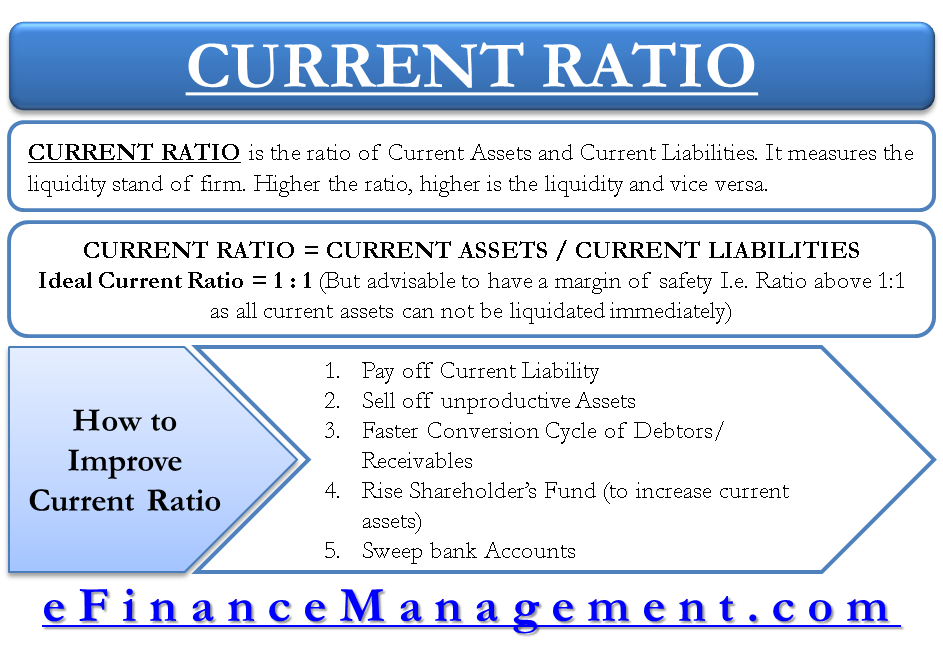

The most obvious way to swiftly increase your liquidity ratio is by paying off liabilities.

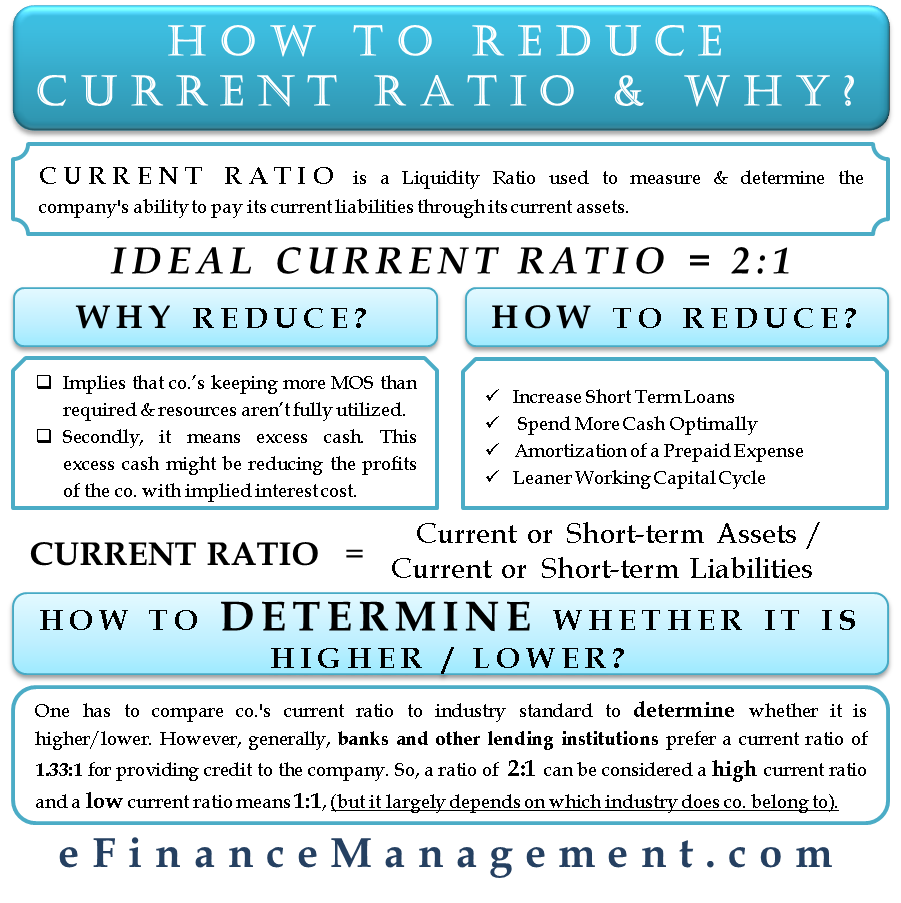

How to increase liquidity. Increasing your working capital in the short term is easy, but only if you make. For the majority of banks right now, the following. Liquidity is hard to come by, but only if you approach business financing with a closed mind.

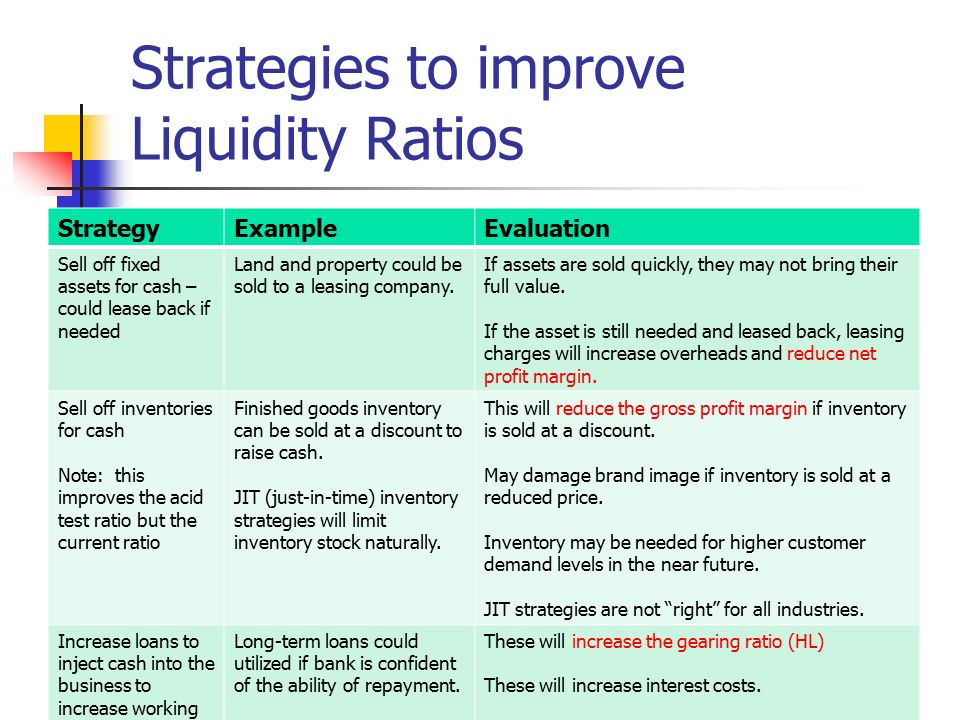

5 ways to improve your liquidity ratios early invoice submission:. If you can use for example an antique car as collateral against a. Through delaying certain tax payments and through using information from credit registries and.

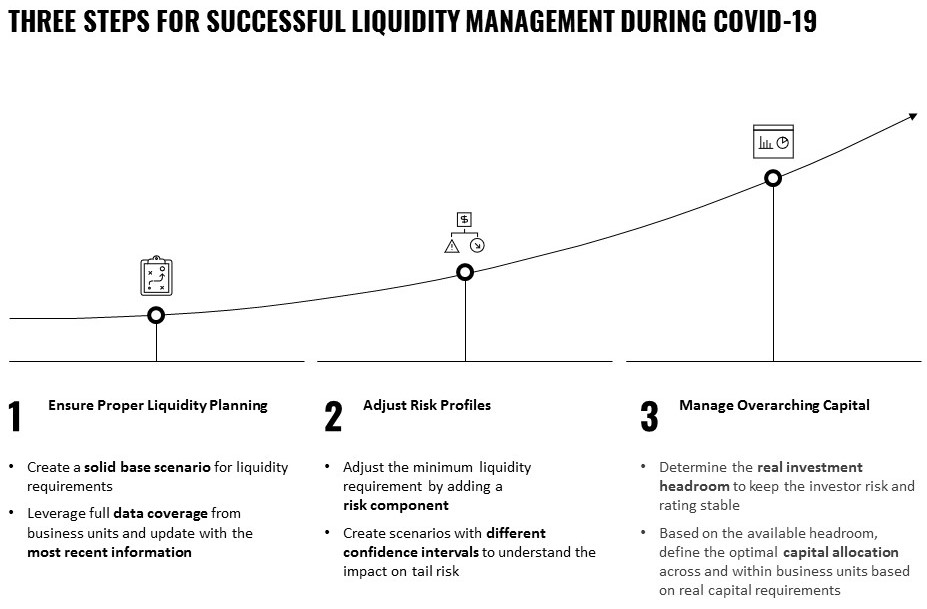

If you want a brief guide, there are the following ways to increase the liquidity of an enterprise: How to improve liquidity restructure your business debt. Businesses that carry a significant amount of debt must service these obligations on a.

Submit your invoices as quickly as possible to your customers. To increase liquidity further, we consider next the effects of time consolidation of markets in the form of an electronic call market. Strengthening bank liquidity starts with understanding where your money is coming from and where it might be going.

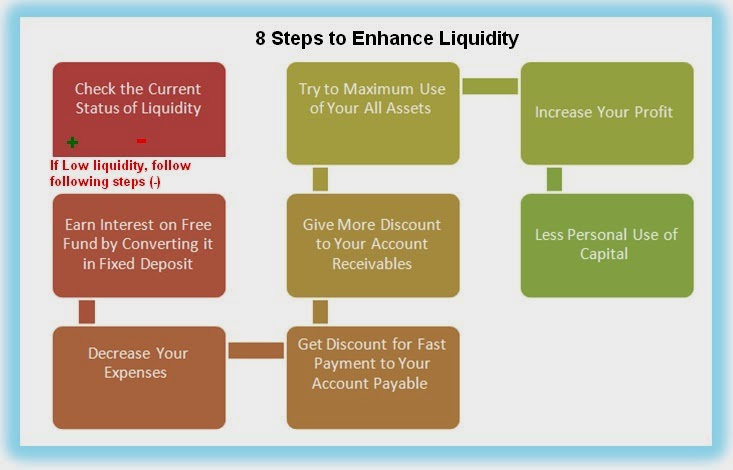

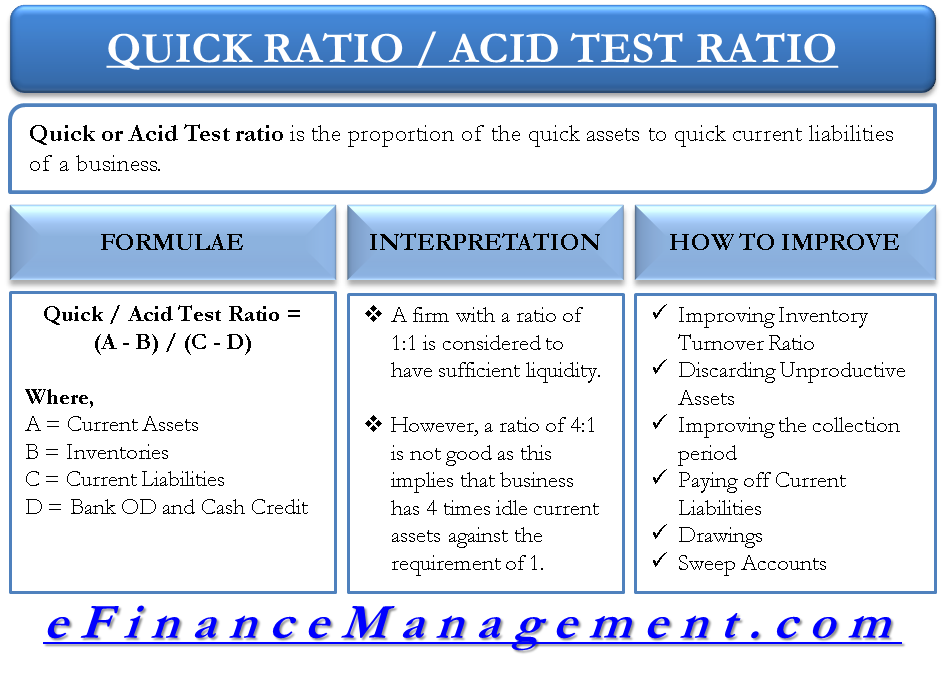

Here are five ways to improve your liquidity ratio if it's on the low side: In earlier blogs we suggested two ways in which liquidity can be increased: If not, there are a number of measures that you can take in order to increase liquidity.

Just make sure the assets you’re selling won’t hurt you in the long. Fr0014005da7) (paris:exn), a global specialist in innovative cybersecurity technologies announced today that it has increased the. Optimise your accounts management accounts payable if poorly managed can severely damage your.

:max_bytes(150000):strip_icc()/UnderstandingLiquidityRisk32-e6abfec5376d4c85a60e0565eb856d37.png)

/GettyImages-1146209256-6c75c20edf10492181fcaa6a63fa9075.jpg)