Supreme Info About How To Maintain Financial Records

This should include paperwork, bills, and unopened mail.

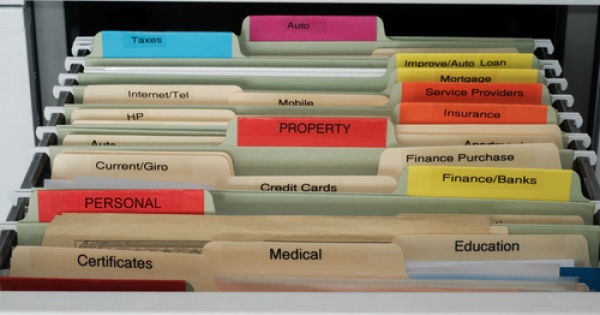

How to maintain financial records. Loginask is here to help you access maintain accounting records quickly and. If you're in an area where the records are needed by many. You could go the traditional route and use a simple set of labeled folders in a file drawer.

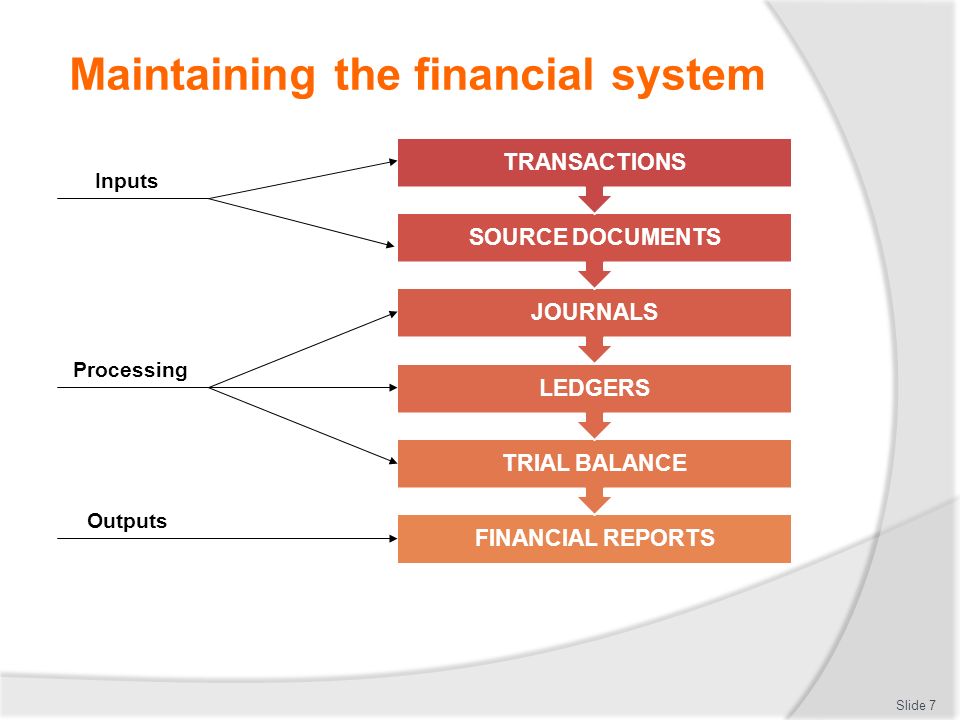

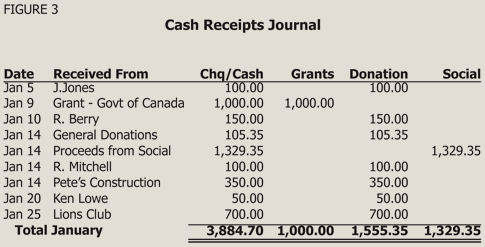

In addition to maintaining evidence of your income and expenses, there should also be a centralized system or log where your financial information is kept and regularly. 1 maintain daily financial records. Gather all your financial documents.

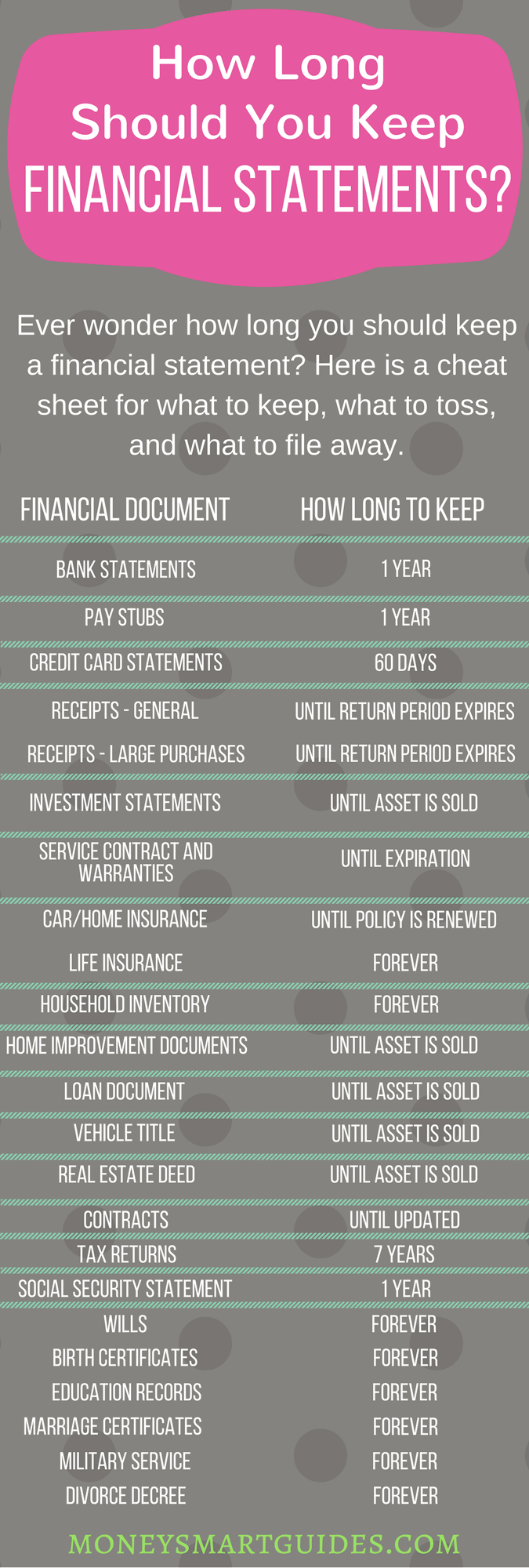

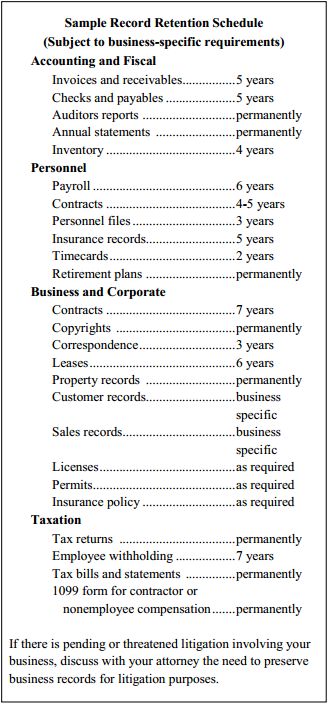

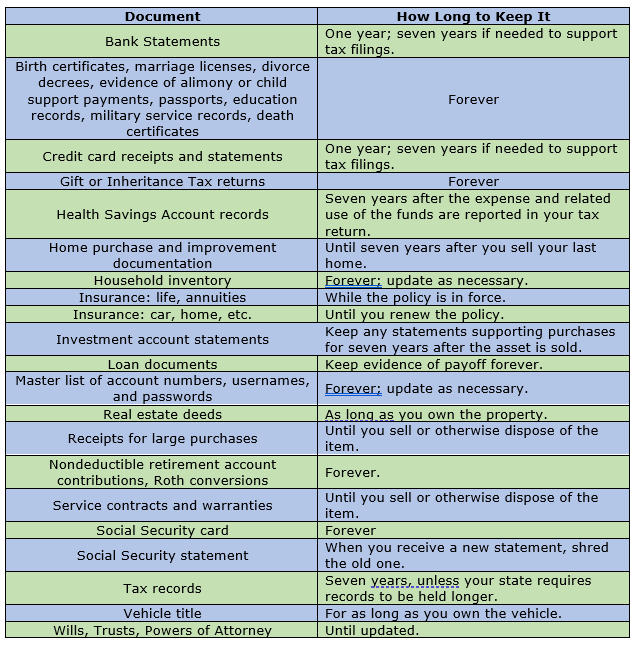

Keep records for 3 years from the date you filed your original return or 2 years from the date. The best way to store your financial records is by scanning important documents and encrypting digital records. 7 tips to help with business financial record keeping 1.

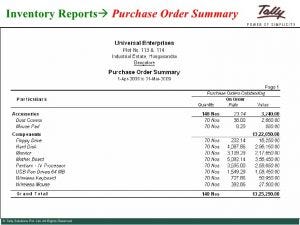

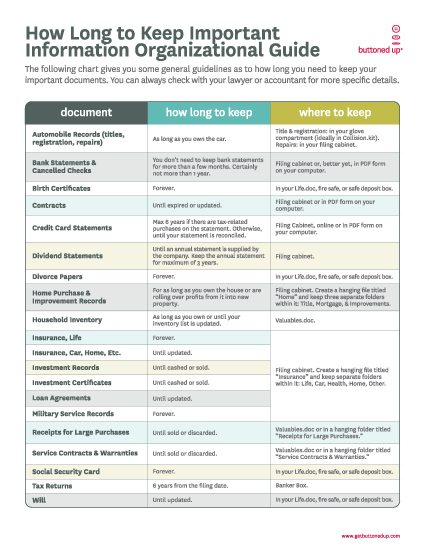

Maintain accounting records will sometimes glitch and take you a long time to try different solutions. If your church is somehow audited, the irs can go back a maximum of seven years when performing their investigation. Use the following table as a guide to organize your.

1.1 correctly maintain daily financial records in accordance with organisational and legislative requirements for accounting purposes. Establish business bank accounts a business must be distinguishable from the owners, and the easiest way to. How to maintain financial records your organization should consult with a lawyer to draft a contract you can use with individuals who receive funds from your organization.

Keep your financial records in one place. Set up a filing system. Consider purchasing a fireproof cabinet or safe.